For many clients, wealth doesn’t sit still — it moves across borders.

Maybe they’ve sold a property in Spain. Maybe they’re retiring abroad. Maybe they’ve just inherited an overseas property or portfolio from a relative they never knew existed (lucky them).

In every one of these scenarios, there’s a quiet but costly risk that often gets overlooked: foreign exchange.

When managed poorly, currency conversion can eat into client wealth.

But when handled strategically, it protects it — and positions you as the trusted advisor adding serious value.

Why FX Deserves a Seat at the Wealth Planning Table:

Let’s break it down.

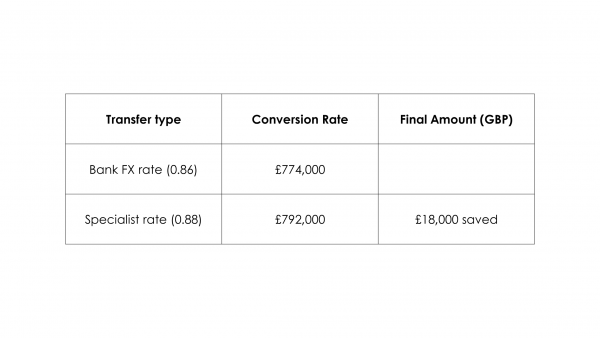

Imagine your client receives a €900,000 inheritance from a family home in Spain.

The agent in Spain converts the funds to Sterling using a local bank and sends it to the UK/IOM bank account.

Job done? Not quite.

Here’s the issue:

- The client has no control over when the exchange happens.

- They’re stuck with whatever rate the bank offers — often padded with hidden margins.

- They’ve unknowingly lost thousands in the process.

Now imagine they had a smarter FX strategy in place:

In this example, a small 2%* improvement in the exchange rate could mean around £18,000 more in your client’s pocket.

Multiply that across multiple clients or property transfers — and the impact becomes enormous.

*actual savings may vary - contact us at enquiries@mfx.im for current rates.

Smarter Foreign Exchange Planning for IFAs:

At MFX, we support IFAs, para-planners, and legal professionals across the Isle of Man and UK, helping them deliver better outcomes for clients involved in international transactions.

Here’s what that looks like:

Personalised FX Strategy:

Every client is different. - We look at market timing, currency trends, and financial goals to craft a tailored approach — whether they need to exchange today or can wait for a better rate tomorrow.

Bank-Beating Rates:

Our FX partners offer consistently competitive rates — often far better than high street banks.

That means your clients save more. You look like a hero.

Local, Client-First Service:

You stay front and centre with your client. We work in the background, as your expert FX partner — discreet, reliable, and always on call.

We’re based right here on the Isle of Man, part of the MFG Group and sister company to Conister Bank. — which means you’re backed by established financial expertise and trusted relationships.

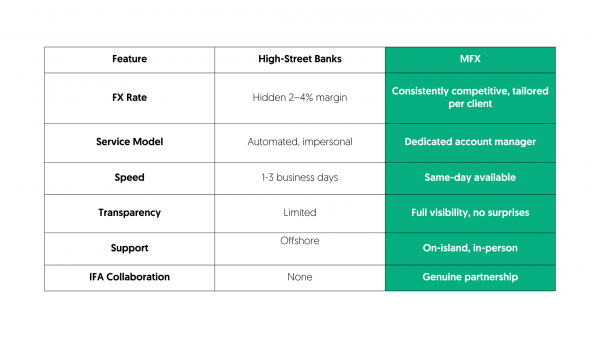

Comparison: Banks vs MFX:

With MFX, professionals don’t lose control of the client relationship — they gain a trusted partner who strengthens it.

Why Advisors Partner with MFX

You already manage complex financial decisions for your clients.

But foreign exchange planning is a specialist area — one that deserves dedicated support.

With MFX, you:

- Stay in control of your client relationship

- Deliver better outcomes

- Add real, measurable value

We make international money movement smarter, faster, and more transparent — without the jargon or the hassle.

Book a Chat with MFX:

We’re meeting with IFAs, para-planners, and legal professionals across the Isle of Man this month.

Let’s talk about how smarter FX planning can help you protect your clients’ wealth — and strengthen your role as their most trusted advisor.

→ Book a chat: enquiries@mfx.im

FX Planning: Quick FAQ for IFAs:

1. Why should IFAs care about FX in wealth planning?

Because exchange rates can quietly erode the value of your client’s international assets. A solid FX plan keeps more of that wealth intact.

2. How does MFX support advisors?

We provide a discreet, white-label service — keeping you at the helm while offering expert market insight, rate comparisons, and fast execution support.

3. Can MFX help with more than just inheritances?

Absolutely. From overseas property purchases and international pensions to business transfers and regular income payments — we’ve got your clients covered.

4. Are MFX based in the Isle of Man?

Yes! We’re part of the MFG Group, local to the Isle of Man, and sister company to Conister Bank. Your clients aren’t just supported — they’re supported locally.